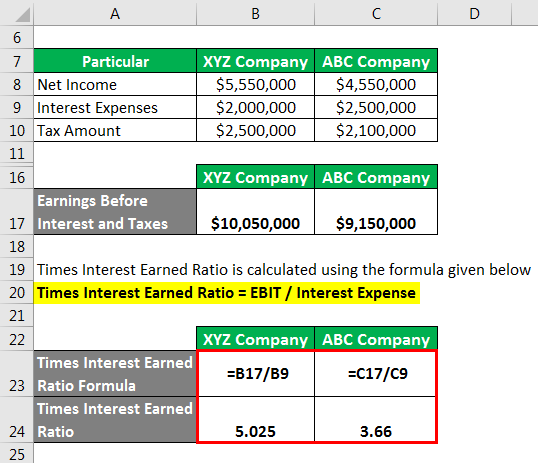

You can now use this information and the TIE formula provided above to calculate Company W’s time interest earned ratio. The interest coverage ratio (ICR) is preferred to be calculated by quarters, but it is the same result with yearly data. On a corporate level, companies can go to the stock exchange to sell a percentage of their ownership in return for cash. If the TIE ratio is exactly 1, it means the company’s EBIT is just enough to cover its interest expenses, leaving no room for error or additional financial strain. The TIE ratio uses EBIT, which excludes taxes, so tax benefits do not directly affect the calculation. However, tax advantages can improve overall financial performance.

Understanding the Times Interest Earned Ratio

A TIE ratio of 5 means you earn enough money to afford 5 times the amount of your current debt interest — and could probably take on a little more debt if necessary. One goal of banks and loan providers is to ensure you don’t do so with money or, more specifically, with debts used to fund your business operations. Looking at a company’s ratios every quarter over many years lets investors know whether the ratio is improving, declining, or stable.

- Specifically, it means the company’s earnings before interest and taxes are ten times greater than its interest expenses.

- The ratio is not calculated by dividing net income with total interest expense for one particular accounting period.

- In that case, it means the company is not generating enough to pay the interest on its loans and might have to dig into the cash reserves, affecting company liquidity.

- Dill’s founders are still paying off the startup loan they took at opening, which was $1,000,000.

- Company XYZ has operating income before taxes of $150,000, and the total interest cost for the firm for the fiscal year was $30,000.

Related Calculators:

The ratio does not seek to determine how profitable a company is but rather its capability to pay off its debt and remain financially solvent. If a company can no longer make interest payments on its debt, it is most likely not solvent. Obviously, no company needs to cover its debts several times over in order to survive.

What does a times interest earned ratio of 10 times indicate?

A lower times interest earned ratio indicates that fewer earnings are accessible to fulfill interest payments. To avoid bankruptcy, a company must fulfill these responsibilities. This ratio is a reference for lenders and borrowers in assessing a company’s debt capacity. A higher ratio is favorable as it indicates the Company is earning higher than it owes and will be able to service its obligations. In contrast, a lower ratio indicates the company may not be able to fulfill its obligation.

As a rule, companies that generate consistent annual earnings are likely to carry more debt as a percentage of total capitalization. If a lender sees a history of generating consistent earnings, the firm will be considered a better credit risk. A TIE ratio of 10 is generally considered strong and indicates that the company has a substantial buffer to cover its interest obligations.

This additional amount tacked onto your debts is your interest expense. In other words, a ratio of 4 means that a company makes enough income to pay for its total interest expense 4 times over. Said another way, this company’s income is 4 times higher than its interest expense for the year. DHFL, one of the listed companies, has been losing its market capitalization in recent years as its share price has started deteriorating. From the average price of 620 per share, it has come down to 49 per share market price.

Specifically, it means the company’s earnings before interest and taxes are ten times greater than its interest expenses. Now, let’s talk about what a good times interest earned ratio is. A good TIE ratio is subjective and can vary widely depending on the industry, economic conditions, and the specific circumstances of a company.

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. My Accounting Course is a world-class educational resource developed by experts to its time for those who benefited from a housing boom to pay up simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. This is a measure of how well a firm can cover interest costs with its earnings.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.